Global investments in renewable energy surged to $358 billion during the first half of 2023, marking a 22% increase compared to the same period in the previous year. This figure, which comes from BloombergNEF’s 2H 2023 Renewable Energy Investment Tracker report, published on August 21, 2023, sets a record for any six-month timeframe. Within this total, $335 billion was directed towards project deployment, encompassing both asset finance and small-scale solar ventures. This amount represented a 14% growth from the initial six months of 2022, underscoring the ongoing momentum of the renewable energy transition.

Equity funding for renewable energy enterprises also saw significant gains this year. Venture capital and private equity expansions directed towards these companies reached $10.4 billion in the first half of 2023, marking a 25% surge from the same period in 2022. Additionally, new equity raised through public markets reached $12.7 billion during the initial six months of the year, showing a 25% increase from 1H 2022.

Leading the way, China remained the largest market for renewable energy investments in 1H 2023, securing $177 billion, which reflected a 16% increase from the same period in the prior year. The United States followed with $36 billion, while Germany attracted $11.9 billion in investments.

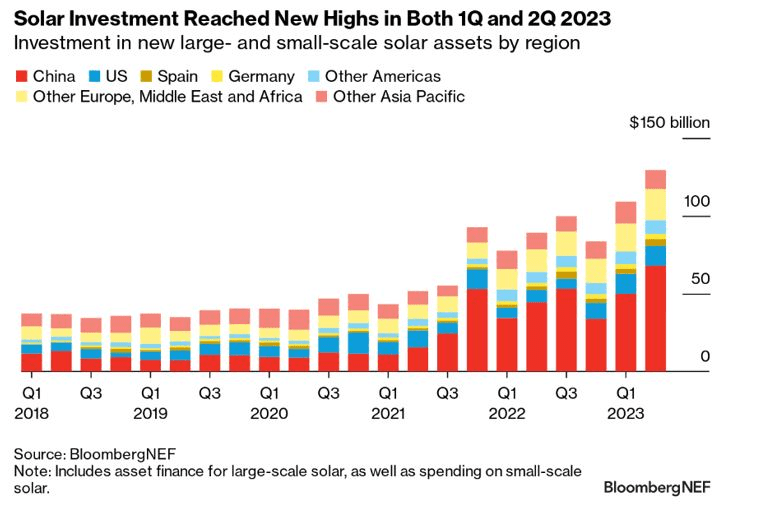

A significant driver behind the remarkable results of 1H 2023 was solar energy. Investments in both large- and small-scale solar systems reached $239 billion, constituting two-thirds of the global renewable energy investment for the first half of the year. This figure marked a substantial 43% rise compared to 1H 2022. Notably, China accounted for about half of all solar investments during this period, largely due to lower module costs, a robust rooftop photovoltaic market, and the implementation of large-scale wind and solar projects in desert regions.

While solar investment experienced exceptional growth, wind power investment faced challenges, declining by 8% compared to 1H 2022, reaching $94 billion during the first half of 2023. Onshore wind investment saw a 21% drop to $64.5 billion, primarily due to grid limitations, permitting issues, and weakening policy support in various markets. China contributed significantly to onshore wind investment, accounting for $38 billion in 1H 2023. Offshore wind investment, on the other hand, increased by 47% relative to 1H 2022, reaching $29.2 billion, with Europe playing a major role in this growth.

Despite these impressive investment figures, the pace of spending on renewable energy deployment needs to increase by 76% to align with a net-zero trajectory. BloombergNEF’s New Energy Outlook suggests that a total of $8.3 trillion needs to be invested in renewable energy deployment between 2023 and 2030 to achieve a global net-zero path by 2050. This would require around $590 billion of investment via asset finance and small-scale solar every six months. While the $335 billion invested in these areas during 1H 2023 is significant, it falls short of what’s necessary to stay on course for net-zero targets.

To effectively address climate goals, renewable energy investments, particularly in wind and solar, must be prioritized, as they are essential for supporting the decarbonization of various sectors through increased electrification.