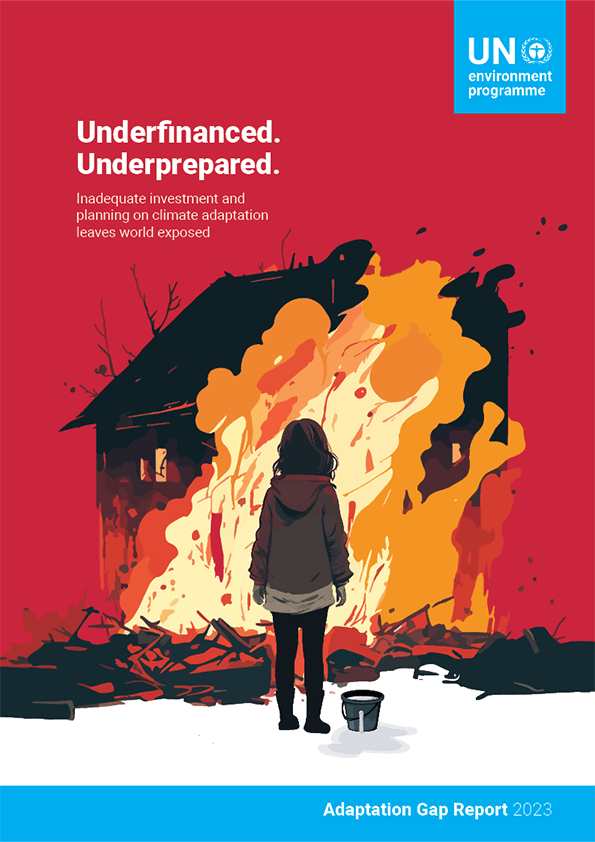

A recent report from the United Nations Environment Programme (UNEP) reveals that progress in climate adaptation is slowing down when it should be accelerating to keep pace with the increasing impacts and risks of climate change. the Adaptation Gap Report 2023: Underfinanced. Underprepared – Inadequate investment and planning on climate adaptation leaves world exposed finds that the adaptation finance needs of developing countries are 10-18 times as big as international public finance flows – over 50 per cent higher than the previous range estimate.

This creates a significant adaptation finance gap, which is now estimated to be between US$194-366 billion per year. At the same time, the efforts to plan and implement climate adaptation measures appear to be stagnating, with dire consequences for the most vulnerable populations.

UN Secretary-General António Guterres emphasized the growing gap between the urgent need for action and the actual efforts being made to protect people from extreme climate events, stressing the importance of immediate action to bridge this adaptation gap.

In light of the increasing financial requirements for adaptation and the decreasing financial support, the report underscores the need for innovative financing mechanisms to address the growing adaptation needs, protect vulnerable populations, and reduce losses and damages. The report also points out the need for ambitious adaptation efforts to enhance resilience, especially in low-income countries and among disadvantaged groups, as well as the importance of mitigating and adapting to climate change.

The report outlines seven ways to increase financing for adaptation, including utilizing domestic expenditure, leveraging international and private sector finance, considering remittances, tailoring finance for small and medium enterprises, implementing Article 2.1(c) of the Paris Agreement to shift finance flows towards low-carbon and climate-resilient development, and reforming the global financial architecture as proposed by the Bridgetown Initiative. Additionally, a new loss and damage fund is highlighted as a crucial instrument to mobilize resources, but it is noted that more innovative financing mechanisms are needed to reach the required level of investment.