Biodiversity is an indispensable block of natural capital assets and underpins multiple ecosystem services they generate. It provides a responsive framework for all primary, secondary, and even tertiary business entities, creating an impact on biodiversity either directly through their operations or indirectly through their global supply chains. However, immoderate dependency and consumption have disturbed the entire natural ecosystem. Approximately one million of the estimated 8 million plant and animal species are now threatened with extinction. At the same time, 14 of the 18 categories of nature's services evaluated in 2019 have also deteriorated since 1970 (Global Assessment Report on Biodiversity and Ecosystem Services, 2019).

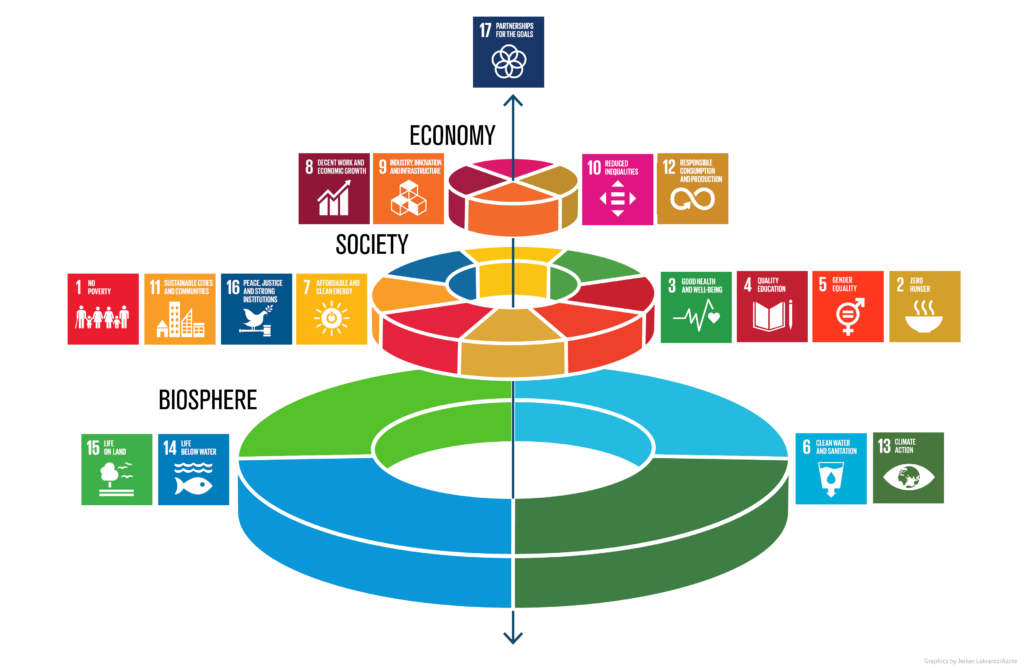

Biodiversity finance is vital in achieving transformational improvements to stop and reverse the loss of biodiversity and ecosystem services. It implies a need to align investment strategies with the Sustainable Development Goals (SDGs) rapidly. An integrated framework given by Stockholm Resilience Centre known as " Wedding Cake" clearly states that some SDGs are non-negotiable. This framework provides a safe operating space within which the economic goals are attained (Stockholm Resilience Centre’s (SRC) contribution to the 2016 Swedish 2030 Agenda HLPF report, 2017). The framework ensures fair and equitable developments extending into the environmental, social, and governance ecosystem where the business operates.

Figure 1 Wedding Cake: The biosphere underpins all other SDGs

Source: https://www.stockholmresilience.org/

The Biodiversity Financing Gap

As per Paulson Institute and Nature Conservancy report, actual expenditure on biodiversity conservation is between $124 billion and $143 billion per year compared to an estimated Overall biodiversity conservation need of between $722 billion and $967 billion per year. As illustrated in figure 2, this accounts for $ 711 billion per year as the biodiversity financing gap.

(Financing Nature: Closing the Global Biodiversity Financing Gap, 2020) .

The Need for a Regulatory Framework: The Task Force on Nature-related Financial Disclosures

As biodiversity-related threats become prominent in the sustainable development agenda, many financial institutions are taking numerous initiatives to turn their attention to more optimistic biodiversity activities and bridge the biodiversity financing gap. One such initiative is the formation of Task-force on Nature-related Financial Disclosures (TNFD). Based on the recommendations (presented in 2017) of the Task Force on Climate-related Financial Disclosures (TCFD), TNFD is a regulatory framework to build awareness and competence to enable the financial sector to reduce the adverse effects of market and systematic failures on nature and biodiversity (TNFD, 2020). The Informal Working Group (IWG), consisting of governments & regulatory bodies, banks & financial institutions, and think tanks, will prepare a

the two-year work programme for the Task Force. They will work together to maximize the opportunities for efficient biodiversity management by discussing financial institutions’ reporting frameworks, metrics, and data needs, allowing them to acknowledge their threats, dependencies, and impacts on nature. World Economic Forum estimated that nature-positive transitions could generate up to US$ 10.1 trillion in annual business value and offer 395 million job openings by 2030. Namely, sustainable aquaculture holds the capacity to create jobs and protect the marine environment. Globally, more than 20.5 million people are currently employed in aquaculture, with Asia responsible for the bulk of employment in the sector at over 19.6 million. Organizations are proposing various solutions for sustainable aquaculture backed by IUCN to demonstrate such projects’ financial sustainability and provide support in rectifying negative impacts generated during decades of unsustainable farming practices (World Economic Forum, 2020).

All such initiatives and the creation of employment opportunities derive from the pressing need to introduce biodiversity conservation in mainstream finance, where capacity and awareness may be lacking (Beyond ' Business as Usual' Biodiversity Targets and Finance, 2020). The materiality assessment of risks related to natural capital for financial institutions and the identification of various categories of risks have improved over the past years. For example, the failing ecosystem services may result in the inaccessibility of natural resources, causing disruptions in production functions. It can propel financial institutions’ credit and investment risks and lead to business loss or poor investment performance (Biodiversity Opportunities and Risks for the Financial Sector, 2020). Imperatively, the finance sector must strengthen risk management and development opportunities to align investment portfolios with global biodiversity goals.

References:

(2020). Retrieved from TNFD: https://tnfd.info/who-we-are/

(2020, Oct 22). Retrieved from World Economic Forum:

https://www.weforum.org/agenda/2020/10/shrimp-aquaculture-jobs-environment/

(2020). Beyond 'Business as Usual': Biodiversity Targets and Finance. Swiss Federal Office for Environment. Retrieved October 13, 2020, from https://www.unepfi.org/wordpress/wpcontent/uploads/2020/06/Beyond-Business-As-Usual-Full-Report.pdf

(2020). Biodiversity Opportunities and Risks for the Financial Sector. Retrieved from

https://www.dnb.nl/binaries/Biodiversity%20opportunities%20risks%20for%20the%20financial%20sor_tcm46-389029.pdf

(2020). Financing Nature: Closing the Global Biodiversity Financing Gap. The Paulson Institute, The

Nature Conservancy, and the Cornell Atkinson Center for Sustainability. Retrieved from https://www.nature.org/content/dam/tnc/nature/en/documents/FINANCINGNATURE_FullReport_09520.pdf

Global Assessment Report on Biodiversity and Ecosystem Services. (2019). Retrieved 2020, from

Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (ipbes): https://ipbes.net/global-assessment

(2017). Stockholm Resilience Centre’s (SRC) contribution to the 2016 Swedish 2030 Agenda HLPF report. Stockholm University. Stockholm: Stockholm Resilience Centre. Retrieved from https://www.stockholmresilience.org/download/18.2561f5bf15a1a341a523695/1488272270868/SRCs%202016%20Swedish%202030%20Agenda%20HLPF%20report%20Final.pdf

Shivani Verma

Shivani Verma is a student at Indian Institute of Forest Management (IIFM), Bhopal, currently pursuing Post Graduate Diploma in Forestry Management (PGDFM). Having knowledge of ESG and Sustainability, equipped with the skill of mass communication, she is a part of vibrant team at JointValues as a content developer.