The World Wide Fund released a new tool at the World Economic Forum meeting in Davos to help companies and investors better understand how they affect and depend on nature.

The Biodiversity Risk Filter from WWF is a free, web-based tool that helps businesses find biodiversity-related risks in their operations, value chains, and investments and take steps to reduce them.

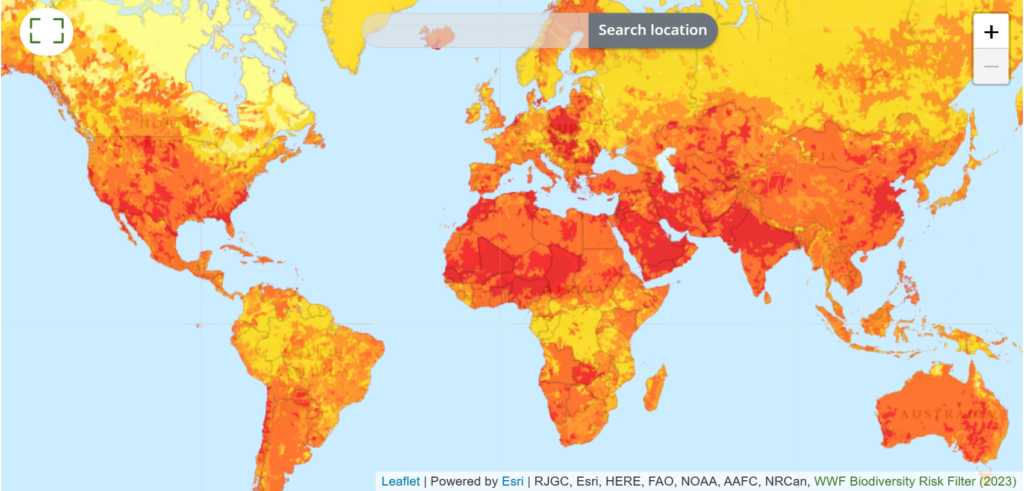

It breaks down complex information about biodiversity using 50 data sets from NASA, IUCN, the World Bank, and many other sources. This makes it easier for decision-makers in all industries and countries to assess risks related to biodiversity.

WWF also released a report called “Tackling Biodiversity Risk,” which used the Biodiversity Risk Filter on 600 companies on the MSCI ACWI index (1). The report finds that most of the companies in the portfolio have a medium or high level of risk related to biodiversity.

According to the World Economic Forum, more than fifty per cent of the global gross domestic product, or $44 trillion, is highly or moderately dependent on nature and its services. Our entire economy and survival depend on natural ecosystems.

Loss of biodiversity is not only an ecological problem but also an economic issue that affects businesses and financial institutions. In December 2022, 330 businesses and financial institutions with combined revenues of over US$1.5 trillion urged world leaders at the Montreal Biodiversity Conference (COP-15) to adopt mandatory requirements by 2030 for all large businesses to assess and disclose their impacts and dependencies on biodiversity.

However, understanding biodiversity-related risks and opportunities along the value chain and across different locations have been one of the most difficult tasks for businesses and financial institutions attempting to develop nature-positive business models recently.

WWF and Climate & Company have published guidance on applying the risk filter to a portfolio of companies and a case study on a representative investor portfolio.

Both risk filter tools support the alignment of companies’ and financial institutions’ sustainability commitments and engagement with global frameworks, such as the Taskforce on Nature-related Financial Disclosures (TNFD), the Science-Based Targets Network (SBTN), and the United Nations Sustainable Development Goals (SDGs).

WWF and Climate & Company also conducted a case study on a representative portfolio of listed companies owned by an investor. According to the case study’s findings, most portfolio companies have medium or high exposure to biodiversity-related risks. With the aid of the WWF Biodiversity Risk Filter tool and methodological guidance, companies and financial institutions can begin to analyse and identify potential biodiversity-related risk hotspots to prioritise action.

The launch of the Biodiversity Risk Filter tool coincides with a growing consensus that we must not only halt the destruction of the natural world but also transform our economies and societies into ones that coexist with nature.

Karen Ellis, WWF’s Chief Economist, said: “With nature in freefall, businesses and investors in all sectors are exposed to increasing biodiversity-related risks. WWF’s new Biodiversity Risk Filter is powerful new tool that gives decision makers a clear picture of biodiversity risks so they can make better choices for their companies and, at the same time, help protect and restore nature.”

Rebekah Church, WWF’s Global Biodiversity Stewardship Lead, said: “Increasingly, companies and financial institutions recognise the business case for tackling biodiversity loss, but many simply do not know where to start. Understanding biodiversity-related business risks is the first step towards being able to tackle them and a prerequisite to setting relevant biodiversity targets, something many companies are likely to look at during this year following the adoption of the Global Biodiversity Framework. This tool helps them to map and assess biodiversity-related risks, enabling them to prioritise investments in areas that will make the most impact in mitigating their risks”.