Energy Dome, the company responsible for developing the CO2 Battery, a cutting-edge energy storage solution that provides long-lasting power, has announced that it has successfully raised €40 million (approximately $44 million) in a Series B funding round.

The financing was led by Eni Next, the corporate venture capital division of Eni, a company that invests in high-growth startups with the most disruptive technologies, such as energy storage and fusion, to aid the transition to a zero-carbon future. The round was co-led by Neva SGR, a venture capital firm owned by Intesa Sanpaolo, one of Europe’s biggest banking groups, with a focus on investing in climate tech and energy transition technologies.

The Series B round was also supported by existing investors, including Barclays’ Sustainable Impact Capital, CDP Venture Capital, and Invitalia, among others. Japan Energy Fund, Elemental Excelerator, and Novum Capital Partners, among others, also participated in the funding round. This latest investment round brings Energy Dome’s total invested capital to €54 million, and the funds raised will help the company expand globally.

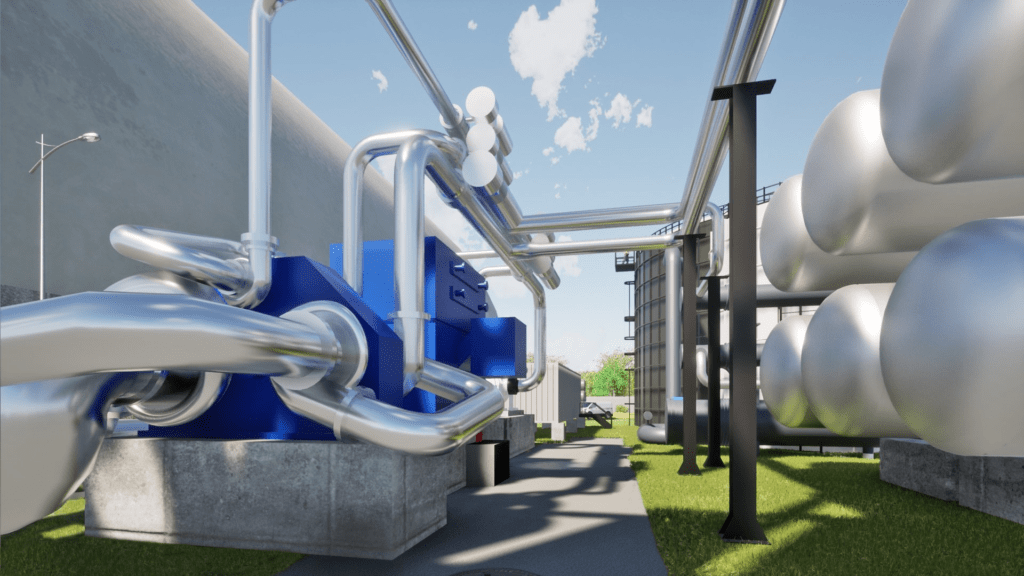

Claudio Spadacini, Energy Dome’s Founder and CEO, expressed his excitement at the company’s successful financing round, explaining that the CO2 Battery™ can store renewable energy with 75% RTE (AC-AC, MV-MV) at half the cost of lithium. The battery has no degradation over 30 years, is made of steel, water, and CO2, and is composed of existing components that any power plant operator can maintain and operate.

Energy Dome has already formed partnerships with several utilities, independent power producers, and corporate customers in major markets worldwide, resulting in a qualified pipeline that exceeds 9GWh in markets such as the U.S., Europe, South America, India, and Australia. The company’s short-term goal is to maintain its momentum and to have two standard 20MW-200MWh frames commercially operational by the end of 2024.