According to recent research by Morningstar Sustainalytics, only 30% of over 4,200 analyzed companies have a robust level of board independence, where at least two-thirds of the board members are independent directors. This comes as corporate governance practices face growing scrutiny. The majority of companies assessed by Sustainalytics’ ESG Risk Ratings were found to have moderate corporate governance management scores.

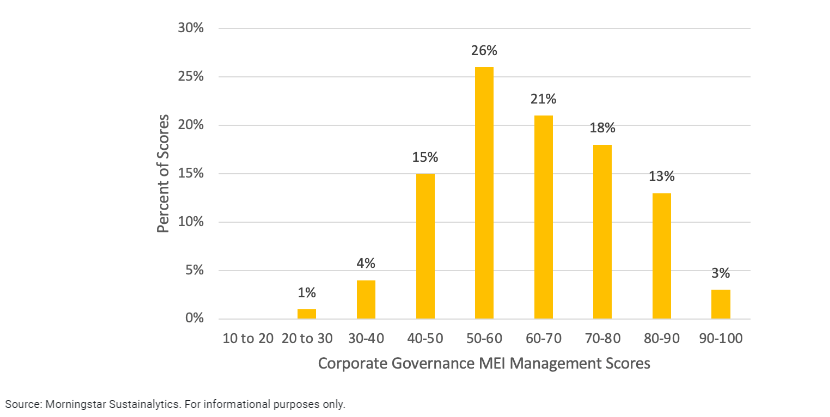

Sustainalytics, a leading provider of ESG risk ratings, recently updated its corporate governance methodology, revealing that over 60% of companies scored between 40 and 70 on a 0 to 100 scale, where higher scores indicate better governance practices.

Distribution of Corporate Governance Management Scores in Sustainalytics’ ESG Risk Ratings Universe

Henry Hofman – ESG Research Director, Corporate Governance, Morningstar Sustainalytics:

“Corporate governance is not only a core component of ESG, but also a material part of any investment decision. At its best, it can help ensure alignment, transparency and trust between investors and management. At its worst, it can be the root cause behind the collapse of long-standing institutions. Robust measures of corporate governance practices should play an important role in any investment approach.”