According to the 2023 Status Report of the Task Force on Climate-related Financial Disclosures (TCFD), companies are now disclosing their climate-related risks and opportunities to the public at a significantly higher rate than just a few years ago. However, there is still substantial room for improvement in reporting, as the majority of companies have not yet fully adopted all of the TCFD recommendations.

This latest status report is the sixth and final annual update released by the TCFD, as the responsibility for overseeing the progress of climate-related reporting has now been transferred to the International Sustainability Standards Board (ISSB) of the IFRS Foundation. This transfer comes after the ISSB’s recent publication of global standards for sustainability and climate reporting.

In more specific terms, the report reveals the following findings:

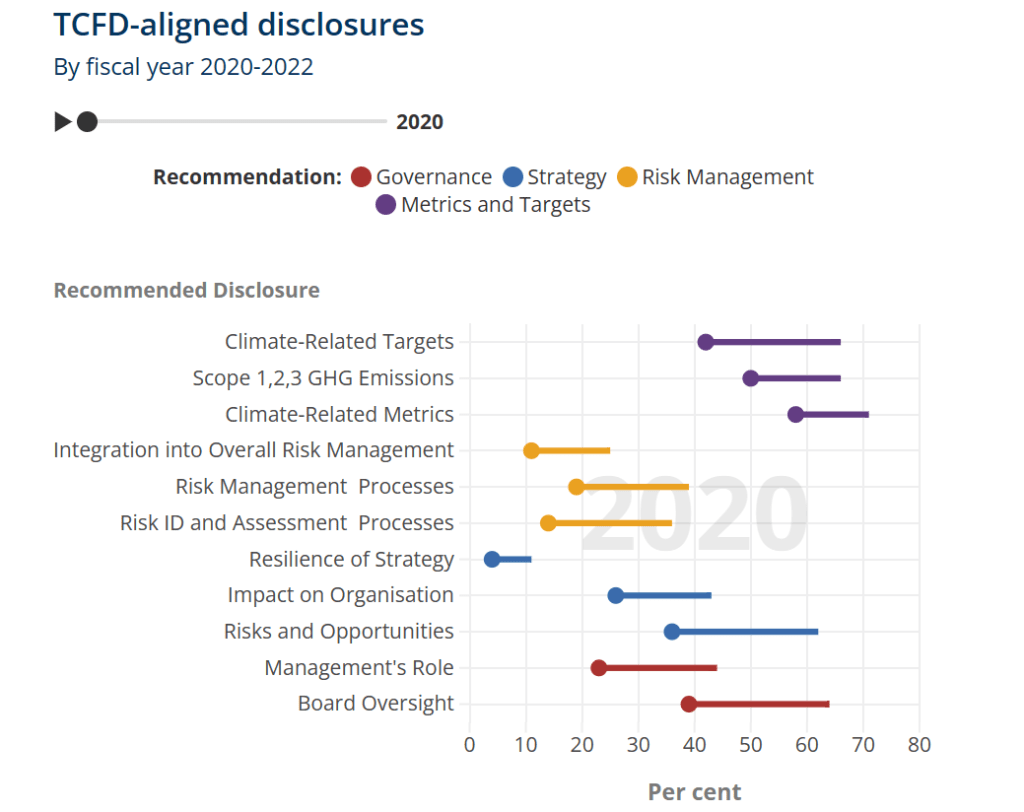

- The proportion of companies disclosing information in line with the TCFD recommendations continues to rise, but there’s room for further improvement. For the fiscal year 2022, 58% of companies disclosed in alignment with at least five of the eleven recommended disclosures, a significant increase from 18% in 2020. However, only 4% of companies managed to align with all eleven recommendations.

- Between fiscal years 2020 and 2022, there was a significant increase in the percentage of companies reporting on climate-related risks or opportunities, board oversight, and climate-related targets, with gains of 26%, 25%, and 24%, respectively.

- Most jurisdictions with established or proposed climate-related disclosure requirements stipulate that these disclosures should be included in financial filings or annual reports.

- Over 80% of the largest asset managers and 50% of the largest asset owners reported in alignment with at least one of the 11 recommended disclosures. An analysis of publicly available reports showed that nearly 70% of the top 50 asset managers and 36% of the top 50 asset owners reported in line with at least five of the recommended disclosures.

Furthermore, according to a 2022 TCFD survey, asset managers and asset owners identified the primary challenge in climate-related reporting as the insufficient information provided by investee companies. Asset managers found information from public companies to be the most challenging (62%), while asset owners faced difficulties with information on private investments (84%).

The report also reflects on the TCFD’s work over the past eight years and underscores areas that require sustained attention and further action by the ISSB or other relevant bodies, including:

- Ensuring interoperability of the ISSB Standards with jurisdictional frameworks to support consistent company reporting across jurisdictions and avoid the need for companies to report through multiple venues.

- Developing implementation guidance on topics such as climate-related physical risk assessment and adaptation planning, climate-related scenario analysis at a sector or industry level, and Scope 3 GHG emissions measurement at a sector or industry level.

- Continuing to focus on companies’ disclosure of the resilience of their strategies under different climate-related scenarios, including a climate-related scenario aligned with the latest international agreement on climate change.

- Continuing to focus on decision-useful disclosures on other sustainability topics – such as biodiversity, water, and social issues – and consideration of the linkages between climate-related and other sustainability issues (for example, in the context of companies’ transition plans).

Developing a consistent climate-related financial disclosure framework for use by countries and other sovereign entities.