Climate change is one of the most pressing challenge of our times. Wildfires are raging in the Amazon, California and Australia. Thousands of people have been displaced. Homes have been lost. Species pushed to the brink of extinction. Corporations bankrupted. Large swathes of vegetation destroyed. Sea levels continue to rise alarmingly. There is also the imminent possibility of more wildfires, student protests and the growth of movements like ‘extinction rebellion’ that can stem from the direct impacts of climate change.

Climate change will put at risk around 2 per cent of global financial assets by the year 2100. A worst-case scenario could see up to 10 per cent of global financial assets being at risk by 2100. For this we need to accelerate our preparation now.

Companies have been reporting the economic risks they face for decades and they often have a statutory responsibility to do so. Generally, the economic risks include the possible negative outcomes that may affect different ‘risk targets’, including the capital resources, net sales, revenues, income from continuing operations and future financial conditions among others.

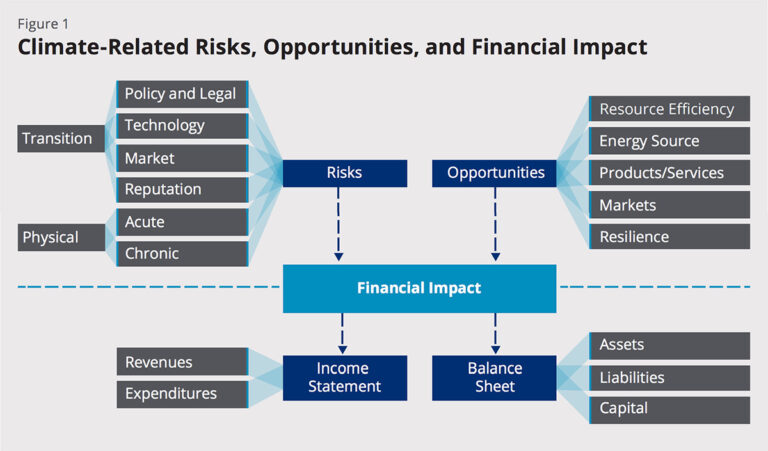

Climate change is also predicted to have possible negative outcomes that could affect any or all of these risk targets. There are both physical risks associated with climate change – those related to extreme weather events and changes in weather patterns – and risks associated with the transition to a low-carbon world. The latter include business risks such as new regulations on greenhouse gas emissions, upfront costs of transitioning to lower emissions technology, uncertainty in market signals and changing consumer preferences.

Though the climate change and environmental matters are classified as “non-financial” information, investors have started acknowledging that they contain material business risk and should be disclosed publicly through the mainstream corporate report, an annual document which includes financial statement and helps investors and stakeholders access the information they need about the company’s activity and financial performance.

Task Force on Climate-related Financial Disclosures (TCFD)

The G20 Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) released recommendations, which highlighted the importance of using scenario analysis to assess climate change-related impacts within the financial sector.

The Task Force recommendations provide a clear and well-defined channel to the companies to bring climate change-related disclosures in mainstream financial reports.

TCFD is an industry-led initiative created to develop a set of recommendations for voluntary climate-related financial disclosures. These recommendations are aimed at all financial actors, from companies and investors to asset owners and managers, as the goal is to provide consistent and transparent information to global markets. It calls for the assessment of both the risk and opportunity side of transition and physical climate change impacts and creates a reporting framework that allows institutions to prepare themselves for upcoming regulations.

There are two main categories of risk related to:

- Transition to a low-carbon economy, including:

- Policy and legal risks associated with GHG emissions pricing and reporting, exposure to litigation and regulation of products and services;

- Technology risks arising from substituting existing products and services with lower emission options, unsuccessful investment in new technologies and the upfront costs of transitioning to lower emissions technology;

- Market risks due to changing consumer behaviour, uncertainty in market signals and increased cost of raw materials;

- Reputational risks due to changing consumer preferences, stigmatization of sectors, increased stakeholder concern or negative feedback.

- Physical impacts of climate change, including:

- Acute risks from extreme weather events;

- Chronic risks from changes in precipitation patterns and extreme variability in weather, rising mean temperatures and rising sea levels.

The Silver-Lining

Climate change is also presenting a myriad of opportunities. Business and the scientific community is investing towards the common goal of a cleaner planet and productive new technologies that raise efficiency at lower impact.

There are five main categories of opportunity:

- Resource efficiency, including the use of more efficient modes of transport, more efficient production and distribution processes, more efficient building, greater use of recycling and reduced water usage and consumption;

- Energy sources that have lower emissions, support policy incentives and that promote energy security and the emergence of new technologies;

- Products and services that reduce emissions, help adapt to climate change, offer insurance risk solutions, innovate and shift consumer preferences;

- Markets, including access to new markets and types of assets that are positioned for transition to the lower-carbon economy and that, are maximized through collaboration with governments, development banks, entrepreneurs, community groups and developing countries;

- Resilience through work with supply chains, capacity building, improved contingency planning, participation on renewable energy and energy efficiency programs, use of resource substitutes, diversification of resources, etc.

JointValues Framework for Evaluation of ESG and Climate Change

Many companies in Asia-Pacific have already started disclosing their ESG performance and impacts using different standards and frameworks including TCFD. Decision making for investment also needs next level information that how climate change and ESG aspects are influencing the market and business ecosystem including regulations in Asia-Pacific that would impact the financials of a company in short, medium and the long term.

JointValues framework for evaluation of ESG and Climate Change related disclosures by the companies is aligned with TCFD and calibrated for the business ecosystem and regulations in Asia-Pacific. JointValues evaluates index companies for their ESG and climate change disclosures and provides information in the public domain and classified reports to investors for empowering better investment decisions.

Benefits for Corporates

Better access to data will help companies explore underlying system-wide exposures and opportunities and can now more effectively measure and evaluate their risks and opportunities within physical boundaries and value chain. Moreover, companies can now help their Investors and other stakeholders assess to what extent they are considering and managing climate-related risks and hence have an increased chance to benchmark and stand out from their peers.

Benefits for Investors

Investors will be able to gain deeper insights into the risk and opportunities facing businesses they are investing in and accordingly can prioritize their engagement strategies. Secondly, they will be able to improve the investment outcome in terms of return enhancement or risk reduction. On the whole, they will easily be able to identify leaders and laggards when it comes to preparedness for transition to a low carbon economy. Lenders, insurers and underwriters will be better able to evaluate their risks and exposures over the short, medium, and long-term.