Companies in India are becoming more aware of the financial impact of climate change as Asia is one of the most vulnerable regions. But, according to a survey done by the top global advisory, broking, and solutions firm WTW, they need the right expertise in managing climate risks, a supportive regulatory environment, and better data accessibility to undertake climate-related financial reporting.

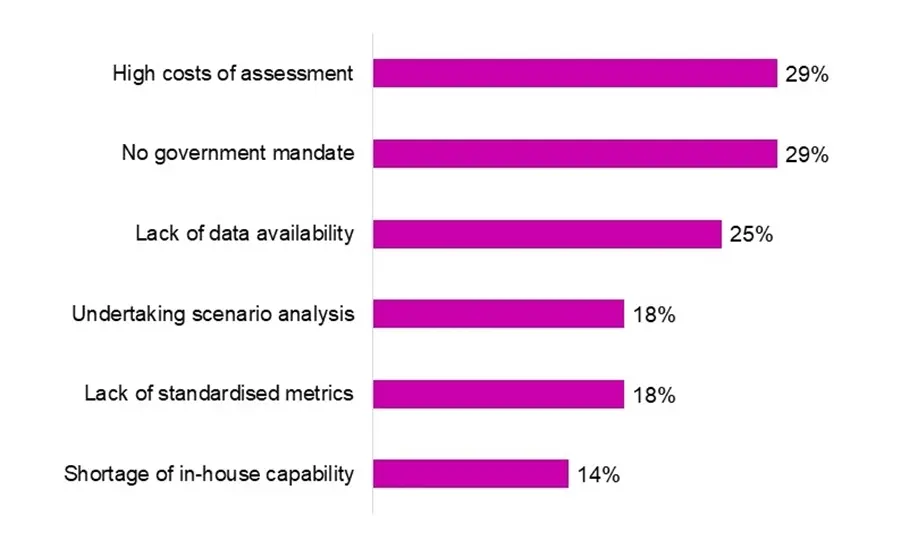

According to respondents, the main obstacles to the widespread adoption of climate-related disclosure frameworks, particularly TCFD, are high assessment costs, a lack of a regulatory mandate, a lack of data and standard metrics, and a lack of internal resources.

Moreover, according to the survey, one in every five businesses considers scenario modelling a critical area requiring guidance and external assistance.

Other key areas of assistance sought include developing the TCFD format and approach (39%), assessing physical risk (36%), and assessing transition risk (36%).

“Companies should partner with experts to bridge the gap with relevant data, analytics, and insight to support climate change governance.”

-Vivek Nath | Head of India, WTW