The pandemic has raised the prominence of ESG factors in funding, financing and in operating an enterprise. ESG considerations have become a conventional facet of sustainable management of key operational parameters balancing sustainable returns with risk reduction and increased accountability of enterprises. The Covid-19 pandemic has exponentially increased the importance of ESG issues acting as a trigger to push for greater integration of ESG into an organizations core business and strategy management including change, risk and crisis management.

A core facet of crisis management is developing an idea of organizational vulnerabilities. Implementing ESG considerations into an organization either through its management strategy, portfolio selection, project selection or operations methodology ensures that all risks and vulnerabilities are documented, raised, escalated if required and resolved as organizational KPIs. Black Swan events which strikeout of the blue and cannot be adequately insured or prepped against only raise the importance of ESG considerations. Organizations with strong ESG considerations can mitigate the effect of black swan events more effectively as their organizational processes do not begin to unravel at the same pace or scale as those organizations that are not structured with ESG considerations in mind.

Fundamentally ESG has to be looked at as something beyond philanthropy but rather as good organizational management and risk management practices formalized into a set of considerations. An ESG aligned organization would find its crisis management playbook fully up to date as various risks are identified not just as probable, would-be future issues but probable could be future issues that can impact costs and need to be addressed today to raise our companies market value today. When organizations align their managerial strategy to ESG in this way then ESG is no longer an added cost or distraction but rather a business value creation and risk mitigation tool.

If ESG can be this transformational and important, why don’t analysts and the regulators ask for ESG reports along with financial statements?

Most financial statements are released at a quarterly, biannually or annually as mandated by the applicable disclosure rules and regulations and good financial and auditing practices. ESG considerations are inherently a long-term issue compared to the short term financial and operational performances discussed and detailed in these financial statements. However, when we navigate the process of financial statement analysis in-depth, we are tangentially discussing ESG considerations – even if they aren’t mentioned or listed as ESG considerations they are present in the statements as capital management issues, environmental penalty issues, damages, write-offs and other financial representations of business problems caused by risk events.

The more important perspective is whether the enterprise wishes to lead the analysts or be led by them in turn. Any well-managed enterprise should look to shape and lead the narrative and not procrastinate on ESG, leaving them to play catchup when analysts do start incorporating ESG considerations while recommending stock options. Research indicates management should not find it an uphill task to conclusively link the reliable connections between enterprise resiliency, business sustainability, survivability and robustness and ESG considerations. There is a dichotomy between what the behaviour of sell-side analysts indicates and what the expectations of buy-side investors are.

Most young investors are projected to pre-empt their investment decisions with ESG considerations or a similar socio-environmental conscious decision-making parameter. A 2018 survey indicates that almost 90% of High Net Worth Millennials would only consider investing if the target enterprise’s ESG record was above their thresholds. An almost equivalent number of polled populaces indicated their values are the central tenet to which their investments would be tailored to. There is a very clear trend of future investments tending to sustainability, which is being driven by the millennial populace who will prefer to invest in enterprises aligned with their personal values in the ESG sphere. Enterprises are projected to lose 80% of their assets when the intergenerational transfer of wealth from ‘Boomers’ to ‘Millennials’ takes place if they are not structured with ESG considerations in mind.

To conclude making ESG considerations a part of organizational strategy is an excellent method of turning the focus from short term profitability (which leads to myopic planning which fails to capture ‘once in a generation’ black swan events) to long term sustainable orientation which aims to ensure the enterprise survives as a going concern for the long haul

Figures:

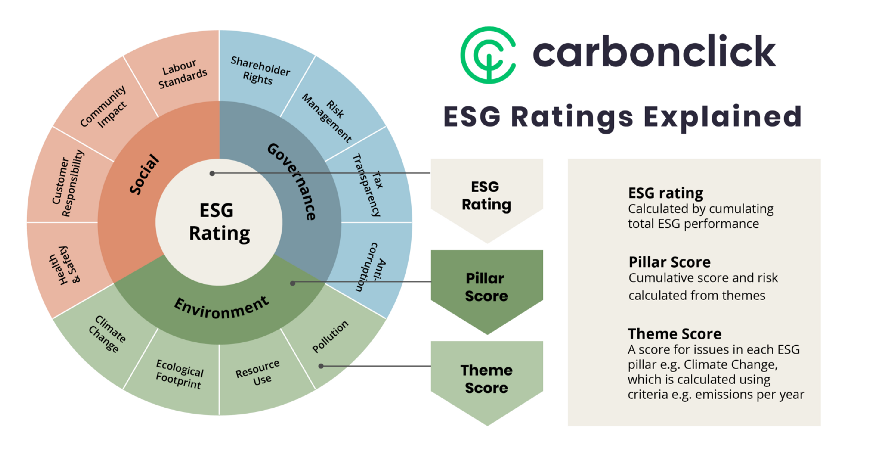

Figure 1: Computation of ESG Score, Source: Jan Caplizscki The Medium

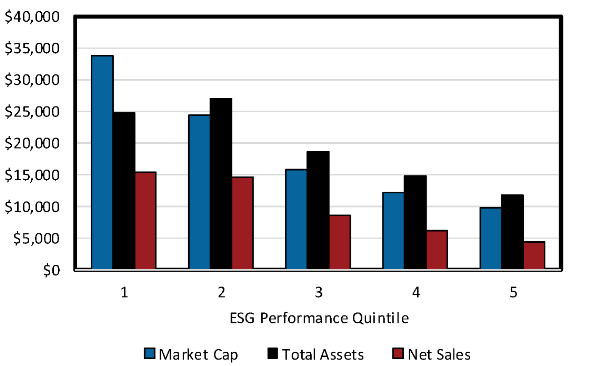

Figure 2: Firms with Higher ESG scores perform better, Source: ISS ESG Research Data

About the Authors:

Karthik Bharath Kumar

Pro-Bono Advisor (Sustainable Finance Solutions)

Karthik has a demonstrated history of 12 years of experience in corporate finance and regulatory functions. With a bachelor’s in Mechanical Engineering from Purdue University and an MBA in Finance from Indian School of Business Hyderabad, he brings strong professional skills in general management, policy, regulations, credit analysis, and credit ratings. Having experience in project finance and investor relations, he is a pro-bono advisor at JointValues for sustainable finance solutions and team building.

Akshay Pai

Akshay is an MBA student at Symbiosis Centre for Management and Human Resource Development, Pune, in the Infrastructure Development and Management program with four years of EPC project experience. He is part of a vibrant team at JointValues for ESG Analysis and Ratings.