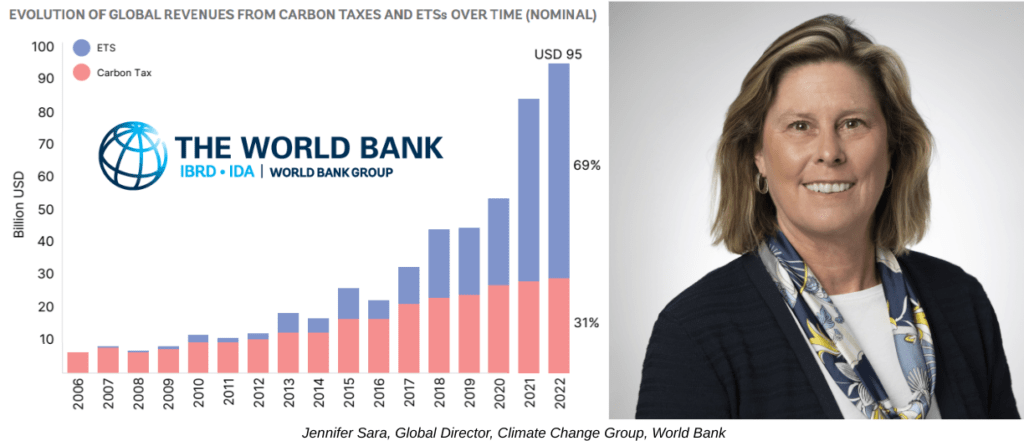

According to a recent report by the World Bank, direct carbon pricing instruments, which are key policies for decarbonization, now encompass approximately 25% of global greenhouse gas emissions. The “State and Trends of Carbon Pricing” report reveals that revenues generated from carbon taxes and Emissions Trading Systems (ETS) have reached a record high of around $95 billion.

This achievement is noteworthy considering the challenging circumstances governments face, including inflation, fiscal pressures, and energy crises. The World Bank emphasizes that carbon pricing can effectively incorporate the costs of climate change into economic decision-making, thereby incentivizing climate action. The report highlights the positive trend of governments prioritizing direct carbon pricing policies, even during difficult economic times. However, the World Bank emphasizes the need for significant advancements in both the coverage and price of carbon pricing to drive the necessary scale of change.

The report indicates substantial progress over the past decade. When the first report was published ten years ago, only 7% of global emissions were covered by carbon taxes or ETS. Today, 73 instruments cover nearly a quarter (23%) of global greenhouse gas emissions. ETS sets a limit on emissions and enables lower-emitting entities to sell their excess emission units to those with higher emissions, establishing a market price for emissions. In contrast, a carbon tax directly sets a price on carbon by defining a tax rate on emissions. While emerging economies are increasingly adopting ETS and carbon taxes, high-income countries still dominate the field. Some countries, such as Austria and Indonesia, have implemented new carbon pricing instruments, while subnational jurisdictions in the United States and Mexico have also taken steps in this direction.

Australia plans to reintroduce carbon pricing through a rate-based ETS starting in July 2023. Additionally, countries including Chile, Malaysia, Vietnam, Thailand, and Turkey are actively working towards implementing direct carbon pricing measures. The report acknowledges a slight slowdown in the issuance and retirement of carbon credits compared to the previous year. Macroeconomic conditions, criticism of carbon credits and offsets, and bottlenecks in issuance contribute to this deceleration. Nevertheless, the report identifies promising signs of international cooperation on carbon markets under the framework of the Paris Agreement.

The report reinforces that carbon pricing serves as an important tool to generate revenue, direct international financial flows, and foster innovation. Combined with a comprehensive policy package, these measures can contribute to broader sustainability and development goals. The World Bank’s Country Climate and Development Reports demonstrate the potential of direct carbon pricing policies to support countries in their development endeavours. The “State and Trends of Carbon Pricing” report was unveiled at the Innovate4Climate conference, the World Bank Group’s premier climate action event held in Bilbao, Spain, from May 23 to 25. The conference facilitates a global dialogue between the public and private sectors, showcasing opportunities and innovations for low-carbon and resilient development while promoting investments in climate-smart solutions.